September 2022 Volume 5, Issue 1

Sauk Valley Community College and Loan Forgiveness

While President Biden’s proposal to forgive outstanding student loans has made waves nation-wide over the past few weeks, knowledge concerning federal student loan forgiveness appears to be limited for students at SVCC.

37 students responded to an online survey conducted by The Skyhawk View concerning the loan forgiveness program. 11 surveyed students indicated that they currently have student loan debt. 9 students displayed interest in utilizing the relief program for debt that was accrued before the eligibility cutoff date.

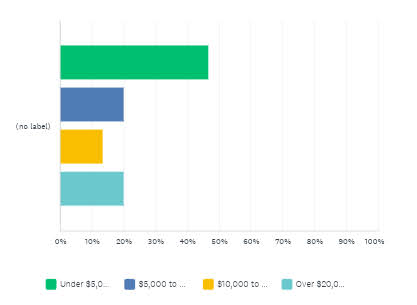

In response to the question “If you are planning to use the federal loan forgiveness program, how much would you need to cover your loan(s)?” 15 students indicated an intention to use the relief - more students than said that they had eligible loan debt.

Eligibility cut-off for federal student loan forgiveness is June 30th of 2022. Students wanting relief for a federal loan taken out after this date will not receive aid through the program. Those who did make the deadline will not receive more aid than is equivalent to outstanding debt.

The program would forgive student loan debt acquired before June 30th of 2022. Those meeting the eligibility requirements would be granted up to $10,000 in loan forgiveness, with up to $20,000 being forgiven in the case of those who received the Federal Pell Grant.

Regardless of eligibility, most students that replied to the survey are in favor of the program. One such reply states “..it gives students (an) opportunity to restart. While it’s a temporary solution to a large problem, it can help to encourage students to not take on future student loans or encourage them to exhaust all other options before taking a new loan out.”